SUPRANATIONAL CURRENCY GES

The idea of a radical reform of the global monetary system on the material-value basis of the world economy is presented, namely: on the basis of the average weighted value of the grain standard IGC (International Grains Council) on the world market, it is proposed to create a supranational monetary unit GES (Grain Equivalent Standard) as an international payment and reserve means. Linking the monetary unit to real material goods will a priori inspire trust in it due to its guaranteed stability in purchasing power over the long term. - Guarantee of stability of the global financial system.

The current world finance crisis prompts the search for a qualitatively new international monetary system that would bring the total money supply into line with the total mass of real assets value in the world, that is, establish global value-monetary parity on the basis of a strong supranational currency as a means of payment and reserve. It is about reformatting the global monetary system on the material and value basis of the real economy by creating a value-adequate international monetary unit. This innovation would rid world finance of the ballast of a materially unsecured money supply, would strike a blow to the fictitious overaccumulation of capital of the “financial economy”, would promote international payments in trade, lending, and investment, which would stimulate the restoration of the producing sector of the real economy.

To implement the global project of a new currency system, it is proposed to create a supranational monetary unit GES (Grain Equivalent Standard) based on the weighted average market value of the International Grain Council (IGC) grain standard according to the algorithm:

1 ton of IGC grain → exchange value of IGC grain (in USD) → monetary unit 1 GES.

The currency formed in this way acquires a value scale of prices, that is, it acquires a nominal-value link to a certain value indicator of a material good taken as a standard, which is IGC grain:

1 GES = weighted average price on the world market for 1 ton of IGC grain.

As a result, the global financial system, based on the material and value foundations of the real economy, optimizes the money supply in terms of value and acquires a perfect toolkit for calculating the value parameters (measures of value) of material goods created by labor, which guarantees the high-quality performance of financial and settlement operations of exchange, payments, accumulation in international economic relations. The advantage of such a currency system is the stability of the monetary unit in terms of its purchasing power in the long run, since the value of the standard IGC grain, on which the GES currency is based, is in line with the long-term trend of the movement in the value of the bulk of commodity products, which is virtually the most important guarantee of the stability of the world financial architecture.

Linking the monetary unit to the long-term price trend of most goods in the economy guarantees the stability of its purchasing power – the stability of the monetary system.

Currency unit GES

The modern world economy is engulfed in a complex of financial and economic shocks caused by the crisis of the world monetary system, a brief list of which boils down to the following acute problems: a) huge government budget deficits exceeding a critical 3% of GDP; b) the total debt in the world is three times higher than global GDP: the public debt of a number of countries, has exceeded their GDP; c) unbridled emission of money supply, which is several times higher than the normal rate of economic growth; d) fictitious capital of astronomical proportions: the volume of derivatives amounts to hundreds of trillions of dollars in the global economy. These are the results of the dominant direction of financial policy in macroeconomics, the essence of which boils down to a massive injection of money into the economy to stimulate economic growth and counteract the crisis phenomena of cyclical development. In practice, this leads to a disconnection of the money supply from the material basis of real assets and a general breakdown of the financial system.

Misunderstanding of the value principles of monetary circulation is the main flaw of modern economic science. Hence the reckless course to "satisfy consumer demand" for money with unrestrained monetary emission and the policy of "quantitative easing – QE", which rapidly increase the money supply in the economy. At the same time, the unbridled increase in the materially unsecured money supply in circulation gave rise to the so-called “financial economy”: the increase in capital not in the sphere of commodity production, but through transactions in stock markets. As a result, the incredible growth of fictitious capital, which depletes the real sector of the economy. This is the result of the financial policy of the modern macroeconomic mainstream. The fundamental reason for its depravity lies in the fact that the monetary system is deprived of a value basis – reliance on the material-cost foundation of the real economy. As a result, world finance found itself in a deep crisis that emerged after the liquidation of the gold-dollar standard of the Bretton Woods system, which manifested itself significantly in 1998. and finally plunged into it in 2008.

Based on the instability of the global financial system, today there is a particularly urgent need for a radical reformation of the global monetary architecture – the creation of a qualitatively new international monetary unit as a reserve and means of payment. This is necessary to curb emission-destructive processes in the economy, stabilize the system of international settlements, normalize the equivalent exchange of goods in trade and overcome the pathological phenomena of the "financial economy". In this regard, we have proposed the idea of reforming the global monetary system on the material-cost basis of the world economy, namely: on the basis of the world-weighted average value of the grain standard IGC (International Grains Council), it is proposed to create a supranational monetary unit GES (Grain Equivalent Standard), as an international means of payment and reserve. The idea is not new. A composite commodity as an «objective standard of value» was proposed back in 1923 by J.M. Keynes in his «Treatise on Monetary Reform». In this case, the IGC grain product is offered as a composite commodity. Why?

First, world grain production is growing in proportion to the growth of the world population.

This synchronicity of population growth and global grain production guarantees equality of supply and demand for this product, which is the key to the formation of a correct (undistorted) price for it.

Secondly, the price dynamics of the IGC grain product is in line with the price dynamics of most products of constant quality, which is a guarantee of the stability of the monetary unit in terms of purchasing power in the long term if it is tied to the market value of the IGC grain standard (benchmark). Note the synchronicity of the long-term price trend for food (which includes IGC grains such as wheat, corn, rice) and industrial raw materials. The average annual downward drift of the value, according to the evidence of authoritative sources, is approximately 1-1.5%.

According to OECD and FAO, “over the past 100 years, real prices for wheat have fallen by an average of 1.5% per year. Similar patterns are evident with respect to other goods”.

Source: OECD-FAO. Agricultural Outlook. Overview of the OECD-FAO Agricultural Outlook 2016-2025. Figure 1.16. Long-term price of wheat in real terms.

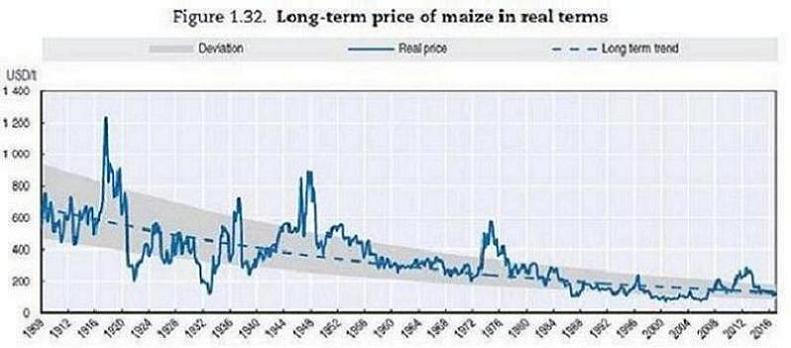

“Real prices of maize have been on a downward trend over the period 1908–2016,” the OECD and FAO continue to note, “with the average price falling by 1.5% per year in real terms. Similar trends are observed for other commodities”.

Source: OECD-FAO. Agricultural Outlook. Overview of the Agricultural Outlook 2017-2026. Figure 1.32. Long-term price of maize in real terms.

The same downward trend in prices applies to other cereals, including rice, and to a decline in the overall food price index, according to FAO.

Source: FAO. Prospects for aggregate agriculture and major commodity groups.

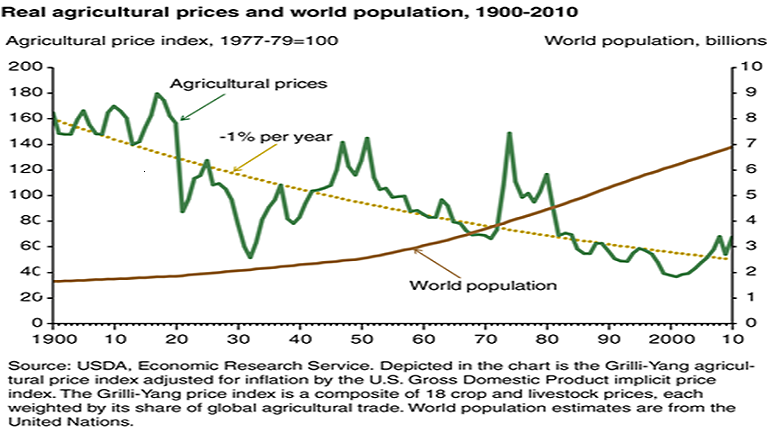

The US Department of Agriculture (USDA) insists on almost the same figures: “In US dollars, adjusted for inflation, prices for agricultural products fell by an average of 1% per year from 1900 to 2010, despite the increase in the world’s population from 1.7 billion to 7 billion people during the same period”.

Source: USDA. Rea agricultural prices have fallen since 1900, even as world population growth accelerated.

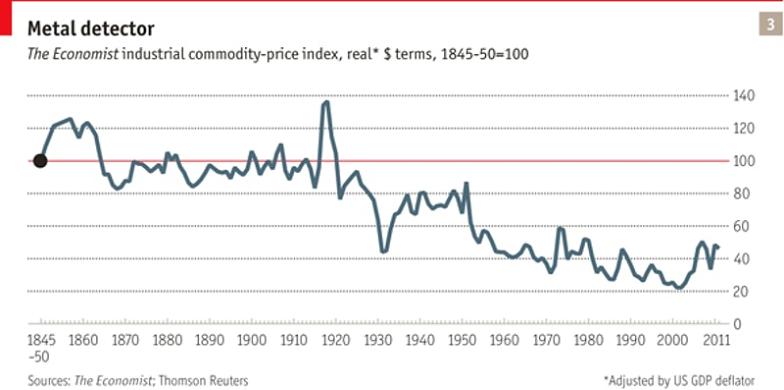

As we can see, the decline in prices (%) for wheat and corn on the one hand, and for agricultural products in general on the other, over the last 100 years is quite comparable. As for the general decline in prices for raw materials for the manufacturing industry, IMF experts, based on data from The Economist magazine, analyzing the behavior of prices from 1862 to 1999, note "a tendency for real prices of raw materials to decline by 1.3% per year over the last 140 years".

Source: The Economist. Resource prices.

Cashin P., McDermott J. The Long-Run Behavior of Commodity Prices: Small Trends and Big Variability.

As we can see, the value of IGC grain is in the trend of the movement of the value of goods of constant quality. The same applies to the entire range of commodity.

Thus, pegging the currency to the market value of the IGC reference grain will provide it with long-term stability in terms of purchasing power: for 1 GES, it will be possible to buy the same amount of goods in 10 years, and in 20 years, and so on... The stability of purchasing power is the most important thing, because it will give confidence to such a currency and guarantee its strength.

As the value basis of the supranational currency, we propose to take the weighted average value of grain of the International Grains Council - IGC. Moreover, to simplify the calculations, it is permissible to limit ourselves to three main grain crops - wheat, corn, rice. Corn makes up about 40% of all grain; wheat - about 30%; rice - about 20%. The share of all of them taken together accounts for almost 90% of all grain production. The algorithm for calculating the cost of the grain standard plus the creation of a monetary unit on its basis is as follows.

1. We take 1 ton of combined IGC grain (wheat, corn, rice in proportions of production and consumption) and establish it as a material-standard foundation of the monetary unit - a grain analogue of an ounce of gold.

2. The average world price for the basic standard "1 ton of IGC grain" over a certain period (10-20 years) is fixed as a monetary sub-standard of value in dollar terms. We get a grain-dollar standard - an analogue of the gold-dollar standard Gold and Exchange Standard. With the difference that there the dollar was tied to the weight of the material (gold) standard, and here - to the cost of the material (grain) standard.

3. Based on the dollar sub-standard of the value of the IGC grain standard, we approve the supranational currency GES (Grain Equivalent Standard):

1 ton of IGC grain → exchange value of IGC grain (in USD) → monetary unit 1 GES

That is, we create a world currency based on the market value of 1 ton of IGC grain according to the algorithm:

STANDARD of goods → SUBSTANDARD of value → currency 1 GES

The monetary unit formed in this way acquires a value scale of prices, that is, it receives a nominal value link to the real value of a material good in the form of the IGC standard grain:

1 GES = market value of 1 ton of IGC grain

From this moment on, the GES currency unit begins to live its own life, being directly tied only to the market value of the IGC grain standard, and the exchange rate of national currencies, including the dollar, is oriented towards the grain currency standard in the form of the GES currency unit.

As a result, the global financial system, based on the material foundations of the real economy, optimizes the money supply in terms of value and acquires a perfect toolkit for calculating the value parameters of material goods created by labor, which guarantees the high-quality performance of financial operations of exchange, payments, accumulation in international economic relations. The advantage of such a currency system is the stability of the monetary unit in terms of its purchasing power in the long run, since the value of the standard IGC grain, on which the GES currency is based, is in line with the long-term trend of the movement in the value of the bulk of commodity products, which is virtually the most important guarantee of the stability of the world financial architecture.

The binding of the GES monetary unit to the drifting value of the reference particle of material goods in the form of IGC grain means its freely floating rate. Accordingly, the price scale of the GES system floats freely in the general flow of value, synchronously with it. - Guarantee of long-term stability of the GES currency in purchasing power. This is a significant advantage of the grain currency standard over the gold currency standard, where the price scale was rigidly fixed at $35 per troy ounce (0.88571 g of gold per dollar), regardless of trends in the market value of the gold standard. This doomed the dollar to be isolated from the value fundamentals of the economy. But even if the dollar was tied to the market value of gold (and not to its weight), the gold exchange standard would not stand the test of practice, since gold is unsuitable as a value standard for the reasons specified in the article. As for the modern system of Special Drawing Rights (SDR), the price scale as such does not exist for it at all. The dollar to SDR exchange rate ($1.35 = 1 SDR as of July 2023) says little about the value parameters of comparison of these currencies, since the dollar itself has no price scale since August 15, 1971.

By the way (very important!), if the US dollar is tied to the GES standard, it may well continue to traditionally play the role of a payment and reserve medium in the world economy, moreover, against the background of growing confidence in it. This would only simplify the monetary system, limiting the GES standard mainly to the function of a measure of value and reducing its role mainly to an exchange rate guide for national currencies.

The main advantage of the GES system is the stability of the purchasing power of its currency. Why purchasing power? Because it is what guarantees the stability of the financial system. In practice, financial stability means: a loan provided or taken must be fully repaid in 10–20 years, and the saved funds must be fully preserved in 10–20 years – in terms of purchasing power in both cases. This is demanded by both businesses and consumers.

The practical task of the GES grain standard should be as follows: a) by fixing national currencies on a solid material and value basis, curb the money-issuing bacchanalia in the world economy; b) on the basis of a value-adequate monetary unit, normalize the equivalent exchange of goods in world trade; c) by curbing the self-growth of fictitious capital, ensure the development of the real sector of the economy. In addition, by qualitatively fulfilling its main function as a measure of value, the new monetary system will significantly simplify the calculation of cost parameters, in particular, when carrying out financial transactions exchange, payments, accumulation, making unnecessary the need for such tools for calculating inflationary distortions of value movements as the GDP deflator and the consumer price index (CPI). All this is possible if there is a cost adequacy of the supranational monetary unit.

What is the current state of the global monetary architecture? Stillborn, in fact, the child of the Jamaican conference against the background of the constant decline of the dollar as a reserve and means of payment. The GES currency, in case of adoption of the grain standard, may well take over the role of SDR. Thus, in the case of reforming the world monetary system on the basis of the IMF (the most optimal option), the structure of this institution, its regulatory tools and functions remain unchanged, with one exception – transfer of the world currency unit from the base of floating rates of five currencies to the base of the GES grain standard: transition from SDR to GES. However, their parallel existence is generally acceptable for exchange rate mutual control and comparative analysis of "GES versus SDR" and clarification of the traditional question: who will beat whom? The advantage of GES over SDR lies in only one thing - a strong material base of the GES currency, which SDR lacks.

Today, if, for example, it were necessary to introduce a supranational GES system, the nominal value of its currency in US dollars would be approximately in the range of 200-300 dollars per 1 GES, according to rough estimates based on statistical data of the International Grains Council, taking into account the average weighted price of IGC grain components on the world market in the proportion of production and consumption over the past 10-20 years. However, in this case, one should not forget about the abnormally high (excessive to the cost of production) price of crude oil since 2004 and its volatility, which significantly distorted grain pricing. Plus COVID and Russian aggression in Ukraine. Therefore, this is not the best time for reform.

Finally, what are the geopolitical implications of adopting a supranation-neutral currency? Normalization of equivalent exchange of goods in world trade, establishing fairness in international settlements and payments, stopping the “export” of inflation by excessively issuing dollars outside the United States – all this would quench the passions around the question “who is robbing whom?” and would reduce the degree of hatred towards the United States. Depriving the dollar of the status of a world currency will have some (by the way, not only negative) consequences for the United States, however, the creation of a high-quality currency architecture is in the interests of the entire civilized world, and this is the main thing.

In conclusion, it is worth reminding once again: the main advantage of the GES system is that the value basis of its currency on the material foundation of the real economy freely drifts downwards along with the value drift of the overwhelming majority of goods.

This is a guarantee of the stability of the GES monetary unit in terms of purchasing power in the long term, a guarantee of the stability of the supranational monetary system and, accordingly, global finance.