MONETARY AND FISCAL POLICY

in order to combat parasitism of the financial economy.

The author's vision of endogenous obstacles to the development of the modern market economy and the ways to overcome them in the direction of macroeconomic policy on the labor-value basis of classical political economy are revealed. Three obstacles to economic growth in the course of its selfflowing (without state intervention) processes have been identified, namely: a) violation of valuemoney parity – loss of value adequacy of money; b) the lagging of solvent demand from the volume of product supply, which with a certain cyclicality blocks the reproductive process of production; c) "overproduction" of fictitious capital, which bleeds the real sector of the economy. Regarding the support of value-monetary parity in the economy, the expediency of applying the "monetary rule" of monetarism has been confirmed: the emission of the money supply to the beat with the increase in real GDP. Cyclical crises of commodity overproduction are caused by the lagging of solvent demand from supply by the amount of capital accumulation, and therefore have no rational options for overcoming them, except for damping sharp changes in cyclicality. The main novelty of the author's proposals is directed against the parasitic essence of the "financial economy", which sprouts in the course of the "overproduction" of fictitious capital. Since the root cause of such a harmful phenomenon is the overprofitability of the financial sector of the economy as a result of the value-speculative revaluation of inflated assets, the essence of the author's innovation comes down to a radical reform of the tax system in order to prevent their speculative revaluation: the transition from income taxation to taxation of the market capitalization (market valuation) of large businesses based on stock price. According to the author's assumption, the tax on the market value of assets should lead to the depreciation of the inflated capitalization of financial pyramids and bubbles, that will direct investments flows to the commodity-producing sector of the economy, exempted from taxation of business profits. As a result the tax reform will deconserve the production capacities of the real economy, will lead to the industrial revival of the countries of the world democracy in the face of authoritarian revenge. Especially if these countries are consolidated on the basis of a coordinated monetary and fiscal policy: a single currency and a unified tax system. Opposing the axis of autocratic evil requires it.

The system of taxation of market capitalization of business means: a) the cancellation of fictitious capital; b) the demonopolization of business; c) the reindustrialization of the economy.

TAX SYSTEM

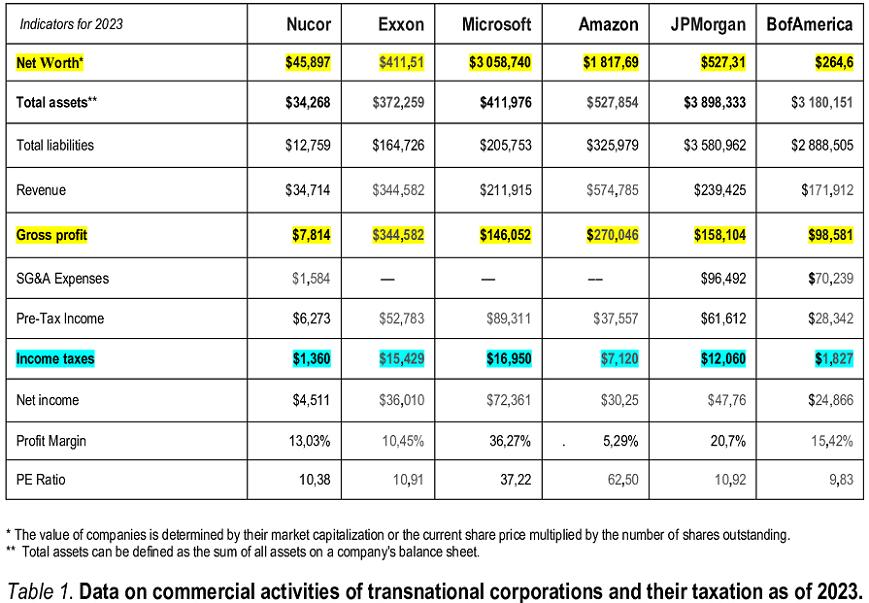

The essence of the idea: it is proposed to introduce a tax on the market capitalization of large businesses instead of taxing entrepreneurial profits due to its ineffectiveness (see the Macrotrends data table on market capitalization, profits and taxes of the largest corporations).

The data in the table, except for "Profit Margin" and "PE Ratio", are presented in billions of USD.

Let's pay attention to the size of tax deductions of the above companies against the background of basic indicators of their capitalization, total assets, annual income (revenue) and gross profit. - An impressive disproportion of taxation to business parameters for each company, continuous questions about the tax base: how is the gross profit subject to taxation formed, what are "commercial and administrative expenses sg&a", the astronomical amounts of which exceed the GDP of many countries of the world and which are outside the tax zone. There are countless questions. The viciousness of such a system is obvious. It should be recalled: "The United States abandoned the progressive scale of profit taxation... Since 2018, a fixed corporate tax rate on profit has been set at 21%." However, judging by the data of "Macrotrends", taxes have a very conditional relation to profit. The possibilities for tax evasion are limitless. Now this problem is very relevant for the USA.

Thus, the state of taxation of large businesses requires a radical revision of the tax system, which is unable to cope with its function, especially against the backdrop of large-scale offshorization. "According to the OECD, the world loses approximately 20 trillion US dollars annually due to offshore zones." Therefore, in the context of globalization, fiscal policy at the national level should be unified, at least to prevent the unwanted flow of capital to offshore zones, which undermines the stability of global finance. In this context, taxation of monopolistic businesses, especially transnational ones, is extremely problematic, given the huge opportunities for the latter to minimize tax deductions or even avoid them. In addition, there is the possibility of maximizing false "production costs" by inflating transfer pricing and other tricks for the formal minimization of profits on which taxes are charged. Finally, there is the speculative parasitism of the "financial economy", oppressing the real sector of the economy as the main tax base. This results in a shortfall in tax revenues, chronic deficits in state budgets, growing borrowing and government debt, progressive credit and monetary emission... And, as a result, financial disorder that has reached an international level.

Fiscal policy has the potential to contribute to the recovery of global finances by closing the loopholes of tax evasion and ending the parasitism of the "financial economy". Given the helplessness of fiscal institutions in today's conditions, we believe that a radical reform of the tax system should be undertaken, namely: abandoning the practice of taxing entrepreneurial profits (there is no truth to be found there), and moving to the practice of taxing the market value - capitalization - of large businesses. The essence of the idea is as follows...

The tax system should:

a) not drive business into the shadows, but bring it to the surface;

b) stimulate economic growth, not slow it down.

Therefore, it is advisable to apply a three-tier tax system.

1. A moderately minimal income tax rate for everyone without exception, a "tithe", so to speak, regardless of the social status of taxpayers: the lower the tax rate, the more accessible its collection.

2. A progressive tax on luxury, for those who have it, regardless of the social or legal status of its owners (will prevent the re-registration of such to fictitious persons, both individuals and legal entities).

3. A flat tax scale for large businesses, but not for entrepreneurial profits, which are very easy to hide, but a tax on... capital, its market value - capitalization. And this is the most interesting thing.

We are talking about taxation of the stock market value – market capitalization – of companies based on the quotations of shares freely traded on the open market. A very simple, transparent, economical, impartial and incorruptible method of taxation: we need one server of the Internet network of the stock market to automatically generate the amount of tax deductions based on the current stock price. This, however, will require unification (standardization) of both business in terms of the formation of its stock market value and the securities market, namely:

1. A single securities market – a stock exchange – with a single algorithm for forming the market value of share capital.

2. Displacing all large businesses, including banking, to the corporatization zone – to the stock market.

What does this mean, what does it solve?

Three most important aspects of taxation of company capitalization.

Firstly, fictitious capital will immediately “deflate”: financial bubbles will burst and financial pyramids, under which there are no real assets, will collapse – the economy will be cleansed of business falsehood. The market capitalization of business will become comparable to its real value, and profitability in the financial sector will fall sharply, which will put an end to speculative games on the stock market.

Secondly, there will be an impetus for the demonopolization of business. In the interests of corporations, it will become desirable to get rid of dubious assets that do not bring real profit as soon as possible. By the way, why not supplement the tax on capitalization (market value) with a tax on assets (book value)? This would only accelerate demonopolization and strengthen the competitive environment of business activity.

Thirdly, the elimination of the profit tax and a significant increase in profitability in the real sector of the economy stimulates investment infusions of capital into the technical modernization of the production capacities of the real economy in order to increase labor productivity and, accordingly, reduction of production costs in order to further increase business profitability.

For the successful implementation of this tax project, equal conditions for business without any preferences from the state and complete economic freedom will be needed - unimpeded movement of investment capital in the sphere of commodity production (up to the average rate of profit) for the sake of adequate formation of market pricing of assets - capitalization.

The complete success of the tax reform will be ensured by the application of its three-level system in a complex. If the capitalization tax (clause 3), by destroying fictitious capital, stimulates productive accumulation of capital = expanded reproduction, then the progressive tax on property excesses (clause 2), subject to the declaration of income and expenses, will force conscientious reporting of the income received, which disciplines the payment of a moderate income tax (clause 1), without much effort of ineffective, and sometimes corrupt control of fiscal services. Consequently, unscrupulous businesses and corrupt officials will be caught in the “income-expense clamps” of the tax system.

The three-tier tax system solves a number of problems of an economic, financial and social nature:

1. Stimulates economic growth rather than inhibits it;

2. Brings business out of the shadows, forcing it to conscientiously fill the budget;

3. By destroying fictitious capital, it improves the financial system;

4. Counteracts business abuses and government corruption.

Despite the fact that fiscal policy is national, in the context of globalization it should be standardized and unified at the interstate level to overcome the destructive phenomenon of offshorization. In order to eliminate the possibility of tax evasion and distortion of the market value (capitalization) of transnational companies on the global stock market by equalizing tax conditions. Internationally agreed taxation of the market capitalization of large businesses will basically destroy fictitious speculative capital and will become a reliable guard against the growth of financial bubbles and pyramids, which will stabilize the global financial system.

Thus, the cancer of the “financial economy” must be overcome by adopting a set of monetary and fiscal measures: a) by optimizing the cost of money, to deprive the economy of the ballast of the materially unsecured money supply; b) by taxing the capitalization of large businesses, to destroy the fictitious component of its market value.

The most important thing in this proposal is the redirection of investment flows from the stock market to the real sector of the economy for the industrial revival (reindustrialization) of Western democracies. Supranational monetary policy should be implemented in conjunction with a tax policy coordinated at the international level, which will strengthen the financial recovery of the global economy and stimulate its growth.

MONETARY AND FISCAL MEASURES TO OVERCOME THEM